- No products in the cart.

[[listData.title]]

dsfasdfsadf

This store has earned the following certifications.

- Certified Secure Certified

- 100% Issue-Free Certified

- Verified Business Certified

- Data Protection Certified

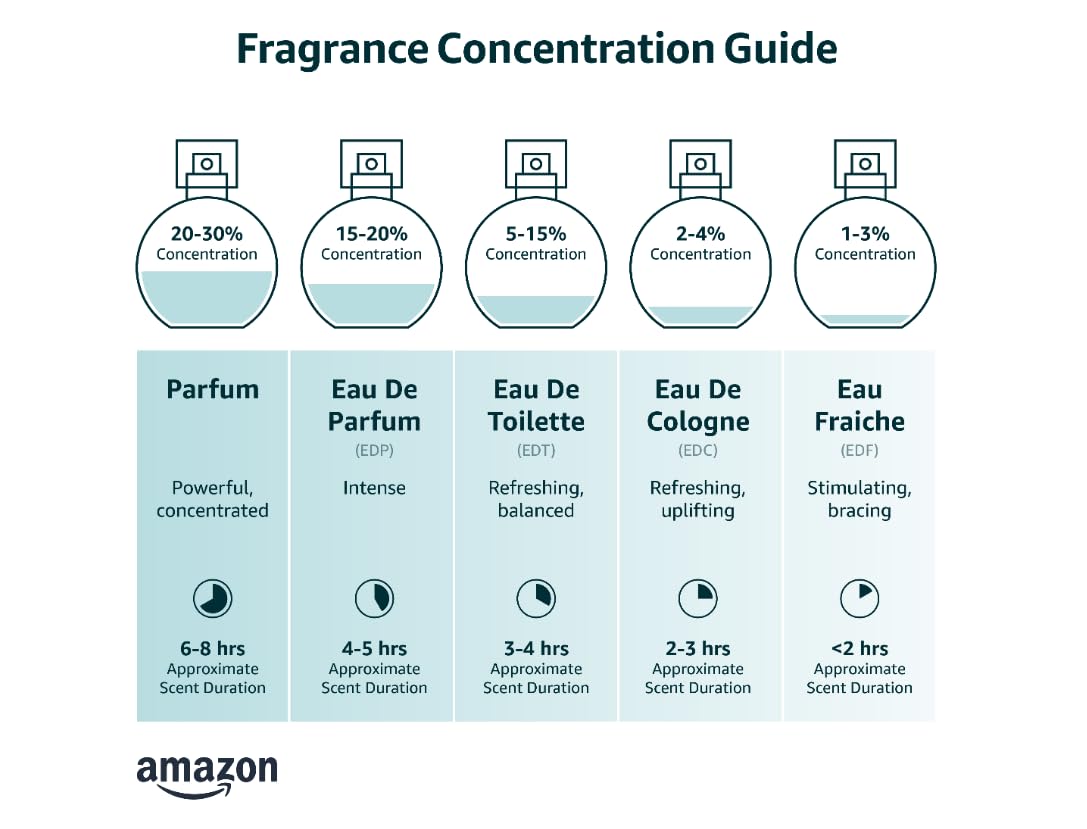

Kilian Unisex Black Phantom Eau De Parfum Refill 50 ml

The global financial crisis that began in 2008 has had a profound impact on the world economy. Originating in the United States housing market, the crisis quickly spread to other sectors and countries, leading to a severe recession. Governments and central banks around the world were forced to implement unprecedented measures to stabilize financial systems and stimulate economic growth.

One of the most significant consequences of the crisis was the collapse of major financial institutions, such as Lehman Brothers and Bear Stearns. The failure of these institutions, which were considered too big to fail, highlighted the systemic risks inherent in the global financial system. Regulators and policymakers were forced to re-evaluate the financial regulatory framework, leading to the introduction of new rules and regulations aimed at reducing the likelihood of future crises.

The crisis also had a profound impact on the real economy, with businesses and households facing significant challenges. Unemployment rates soared, as companies were forced to cut jobs in response to declining demand and tightening credit conditions. Consumer spending and investment plummeted, leading to a widespread economic slowdown.

Governments around the world responded to the crisis with a range of fiscal and monetary policies. Central banks lowered interest rates and implemented quantitative easing programs to increase the money supply and boost economic activity. Governments also introduced fiscal stimulus measures, such as tax cuts and increased public spending, to support economic recovery.

The recovery from the global financial crisis has been a slow and uneven process. Some countries and regions have recovered more quickly than others, with emerging markets like China and India showing stronger growth. However, the crisis has left a lasting impact on the global economy, with many countries still struggling to regain their pre-crisis levels of economic activity.

One of the key lessons from the crisis is the need for greater financial regulation and oversight. Policymakers have recognized the importance of ensuring that the financial system is more resilient and less prone to systemic risks. This has led to the introduction of new regulations, such as the Dodd-Frank Act in the United States and the Basel III capital and liquidity standards, which aim to strengthen the financial system and reduce the likelihood of future crises.

Overall, the global financial crisis of 2008 has had a profound and lasting impact on the world economy. While the immediate crisis has passed, the effects of the crisis continue to be felt, and the lessons learned have informed the development of new policies and regulations aimed at creating a more stable and resilient global financial system.

product information:

| Attribute | Value |

|---|